How to Download the SBI New Passbook Application Form PDF

To download the SBI new passbook application form PDF‚ visit the official SBI website‚ log in to your online banking‚ and navigate to the “Forms” section. Download the specific passbook application form in PDF format directly from the website or use provided links for convenience.

1.1 Step-by-Step Guide to Access the Form Online

To access the SBI new passbook application form online‚ start by visiting the official SBI website and logging into your online banking account. Navigate to the “Forms” or “Downloads” section. Locate the passbook application form‚ click to open it in PDF format‚ and download it using the browser’s save option or a direct link provided by SBI. This streamlined process ensures easy access to the form for submission.

1.2 Direct Links to Download the Form from Official SBI Sources

Visit the official SBI website and navigate to the “Forms & Applications” section. Look for the “Passbook Application Form” link and click to download the PDF directly. Alternatively‚ use the official SBI online banking portal‚ where you can find the form under the “Downloads” section. Ensure you verify the authenticity of the source to avoid unauthorized links. This method provides a secure and reliable way to obtain the form.

Offline Method to Obtain the SBI Passbook Application Form

Visit the nearest SBI branch to collect the passbook application form. Forms are available at the counter or can be requested from bank officials directly.

2.1 Visiting the Nearest SBI Branch for the Form

Visit your nearest SBI branch during working hours and approach the counter. Request the passbook application form‚ which is readily available. Some branches provide pre-printed forms‚ while others may ask you to write a request letter. Ensure you carry required documents like your account number or ID proof for verification. Bank officials will guide you through the process‚ making it a straightforward and efficient method.

2.2 Filling Out the Form Manually at the Branch

Once you obtain the form‚ fill it manually with clear and accurate details. Include your full name‚ account number‚ and other required information. Ensure your signature is affixed in the designated area. Provide any additional documentation if requested‚ such as ID proof. Submit the completed form to the bank officials for verification and processing. This method is straightforward and ensures timely issuance of your new passbook.

Key Information Required to Fill the Passbook Application Form

Include your full name‚ account number‚ and personal details. Ensure accuracy in all fields to avoid delays. Signature and authentication are mandatory for form submission.

3.1 Personal Details and Account Information

Provide your full name‚ account number‚ and residential address. Specify the type of account (savings/current) and include your contact number. Ensure all details are accurate and match bank records. Mandatory fields include your signature for authentication. Cross-verify the information to avoid processing delays. Inaccurate data may lead to form rejection‚ so double-check before submission.

3.2 Signature and Authentication Process

The application form must be signed in the presence of bank officials or as per their guidelines. Ensure your signature matches the one on file with the bank. In some cases‚ a witness signature may be required. Authentication confirms the request’s legitimacy‚ preventing unauthorized passbook issuance. Proper verification ensures the application is processed smoothly and securely‚ maintaining account safety and compliance with bank protocols.

Submission Process for the SBI Passbook Application

Submit the filled form at the nearest SBI branch with required documents. The bank will verify details and process the request; A new passbook is issued within 3-7 working days.

4.1 Submitting the Form at the Branch

Visit your nearest SBI branch and approach the dedicated counter for passbook-related services. Hand over the completed application form along with required documents‚ such as your account passbook or ID proof. The bank staff will verify the details and process your request. Ensure all fields are filled correctly to avoid delays. The submission process is straightforward and typically completed on the same day‚ with the new passbook issued shortly after verification.

4.2 Processing Time and Issuance of the New Passbook

After submitting the form‚ the processing time for the new passbook is typically quick‚ often completed within the same day or a few working days. Once verified‚ the passbook will be issued and handed over to you. Ensure to collect it promptly and keep it safe. In case of delays‚ contact the branch for updates. The issuance process is efficient‚ allowing you to access your updated passbook swiftly.

Writing a Request Letter for a New Passbook

A request letter for a new passbook should be addressed to the branch manager‚ stating your account details and reason for the request. Include your signature and submit it along with required documents for verification.

5.1 Format and Structure of the Request Letter

The request letter for a new passbook must include your account details‚ a clear statement of the reason for the request‚ and your signature; Begin with your name‚ address‚ and date‚ followed by the branch manager’s details. Use a polite tone‚ specify your account number‚ and mention if it’s a duplicate passbook. Conclude with a thank you note and your signature. Ensure the letter is neatly formatted for clarity.

5.2 Sample Letter Template for Reference

State Bank of India

Branch Manager

[Branch Name]

Subject: Request for New Passbook

Dear Sir/Madam‚

I‚ [Your Name]‚ account holder of [Account Number]‚ kindly request issuance of a new passbook. My previous passbook has been [lost/misplaced/damaged]. Please process my request at the earliest.

Thank you for your assistance.

Sincerely‚

[Your Name]

Duplicate Passbook Application Process

To obtain a duplicate passbook‚ submit a written request to your SBI branch. Attach required documents‚ such as a valid ID proof and a fee payment receipt‚ if applicable. The bank will verify your details and issue the duplicate passbook after processing your application.

6.1 Reasons for Issuing a Duplicate Passbook

A duplicate passbook is issued if the original is lost‚ misplaced‚ damaged‚ or stolen. Customers may also request a duplicate if the passbook is worn out or illegible. A formal application and applicable fees (e.g.‚ MVR 50 or USD 3) must be submitted to the bank for processing the duplicate passbook request.

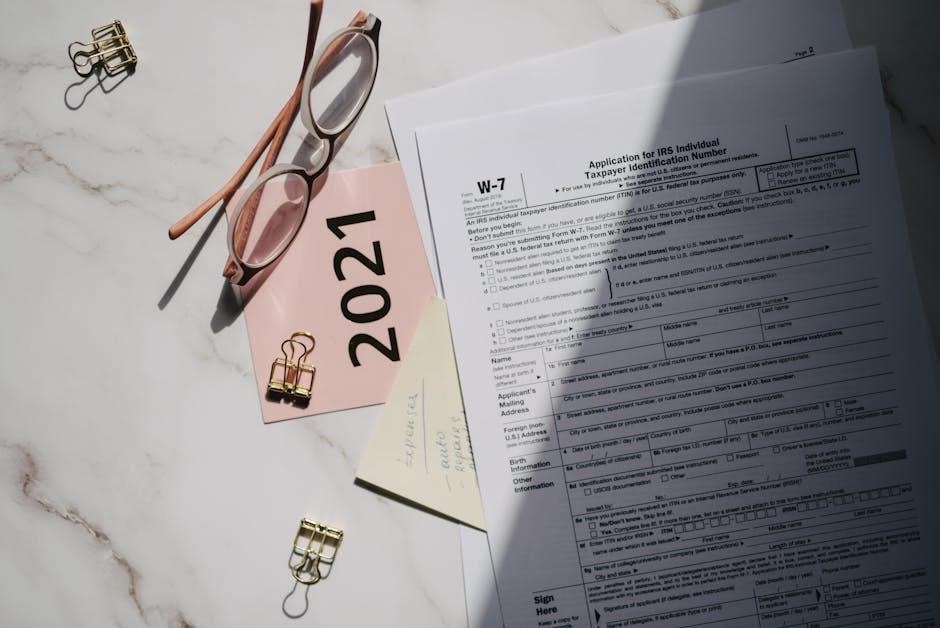

6.2 Required Documentation for Duplicate Passbook

To obtain a duplicate passbook‚ customers must submit a formal application along with their account details. A written request stating the reason for the duplicate (e.g.‚ loss‚ damage) is mandatory. Additional documentation‚ such as identity proof‚ may be required. A nominal fee (e.g.‚ MVR 50 or USD 3) is charged for issuing the duplicate passbook. Ensure all documents are complete to avoid delays in processing the request.

Online Passbook Services by SBI

SBI offers digital passbook services‚ allowing users to download passbook PDFs online via net banking. This service provides convenient access to account details and transaction history.

7.1 How to Download SBI Passbook PDF Online

To download your SBI passbook PDF online‚ log in to your SBI net banking account. Navigate to the “Account Statement” or “Passbook” section. Select your account‚ choose the desired date range‚ and download the passbook in PDF format. A passcode may be required to open the PDF‚ ensuring secure access to your transactions and account details.

- Log in to SBI net banking.

- Navigate to the passbook section.

- Select account and date range.

- Download and open with passcode.

7.2 Benefits of Digital Passbook Services

Digital passbook services offer convenience‚ accessibility‚ and security. You can view transactions anytime‚ anywhere‚ and reduce physical storage needs. They are environmentally friendly‚ cutting paper usage. Digital passbooks also provide easy search and filter options for transactions‚ enhancing financial tracking. Additionally‚ they are securely encrypted‚ protecting your data from unauthorized access. This modern banking solution simplifies account management and keeps your records organized digitally.

- 24/7 access to transaction history.

- Reduced need for physical storage.

- Environmentally friendly.

- Enhanced security with encryption.

Common Queries and Solutions

Common queries include lost or damaged passbooks‚ application status‚ and required documents. Solutions involve submitting a duplicate request‚ checking online status‚ or contacting the nearest SBI branch.

- Lost passbook? Apply for a duplicate.

- Check application status online.

- Contact your nearest SBI branch for assistance.

- How to apply for a duplicate passbook?

- What documents are needed for a new passbook?

- Can I submit the application online?

- How long does it take to issue a new passbook?

- Incomplete form? Fill all mandatory fields.

- Missing signature? Ensure proper authentication.

- Lost passbook? Apply for a duplicate.

- Delayed processing? Follow up with the branch.

8.1 Frequently Asked Questions About Passbook Applications

Common questions include how to apply for a duplicate passbook‚ required documents‚ and processing time. Queries also arise about online application availability and form submission procedures.

These questions are addressed through SBI’s official guidelines and branch assistance.

8.2 Troubleshooting Issues with Passbook Issuance

Common issues include incomplete forms‚ missing signatures‚ or delayed processing. To resolve these‚ ensure all fields are filled correctly and required documents are attached. For lost passbooks‚ submit a request letter and affidavit. If experiencing delays‚ contact the nearest SBI branch for assistance. Proper documentation and adherence to guidelines can help avoid issuance problems.

Obtaining an SBI new passbook is a straightforward process‚ whether done online or offline. By following the steps outlined‚ customers can efficiently download the application form‚ fill it‚ and submit it for processing. SBI’s digital services also offer convenient options for managing passbooks. Ensure all details are accurate to avoid delays. Proper documentation and adherence to guidelines ensure a smooth experience for both new and duplicate passbook requests.